Bitcoin is currently dominating the crypto market and is the biggest cryptocurrency investors are trading with. Price volatility is a big factor in investment with Bitcoin or any other cryptocurrency. It is natural to consider the aftermath of what would happen if or when Bitcoin crashes to zero.

Currently, financial experts have postulated that there are two ways Bitcoin can go from its current position. The first instance predicts extensive investments from different traders due to the fear of hyperinflation, which will give Bitcoin a rise like never before. The second alternative is that it will crash. This article will help you explore the consequences of what will happen if Bitcoin crashes.

Table of Contents

High Risk

Source: thestreet.com/

No one will deny that Bitcoin is not high risk. It tests the risk tolerance of all the investors, and the price volatility leads to a certain unpredictability. Anyone well versed with Bitcoin can tell you that a 30% drop at any given moment is expected. Just because it is currently on a high does not mean that a low will not come.

Any investor going for cryptocurrency is told to diversify their investment portfolio. This is said simply because of the different levels of volatility of different cryptocurrencies so that one may not lose all of their money in case a crash happens. Even though it will be a big financial change for many, it will not impact the entire finance ecosystem.

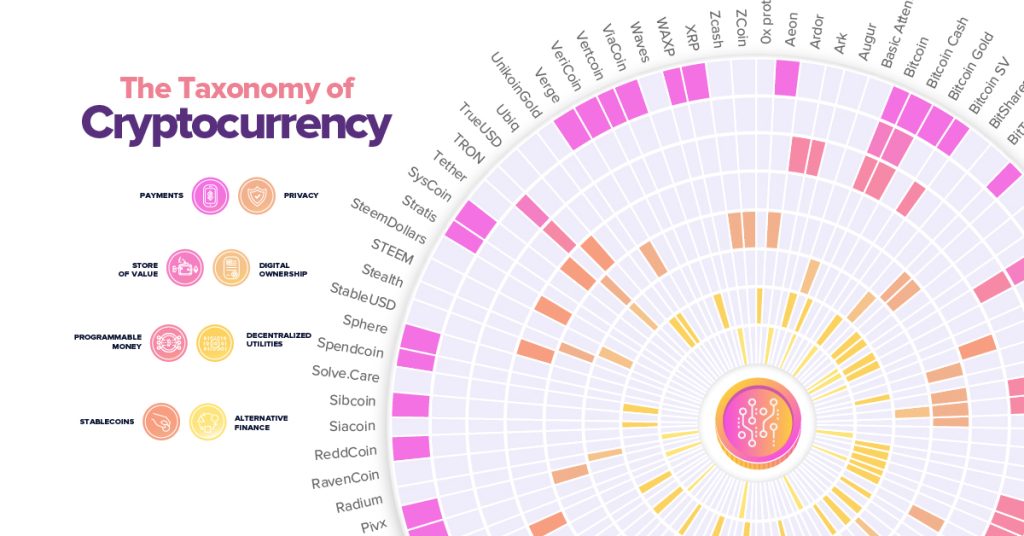

The Cryptocurrency Ecosystem

Source: visualcapitalist.com

While a Bitcoin value crash will not directly impact the financial services ecosystem, the cryptocurrency ecosystem will be significantly impacted. If we try to convert the value of the crash in monetary terms, it will amount to more than 200 billion dollars. You should know about Bitcoin value at https://bitcoin-circuit.live/.

However, this monetary impact is not absolute because there is also the investment in blockchain technology which has to be factored in the event of a crash. Bitcoin is also becoming a mainstream means of transaction with institutional investment, so it will have to be considered in case of a crash.

If we talk about the cryptocurrency ecosystem, Bitcoin dominates the market and, in turn, has increased the face of the investors in different cryptocurrencies.

Several different cryptocurrencies have seen a rise in their value due to the rise of Bitcoin and the trust of investors in cryptocurrency in general. In case of a crash, not only will the value of Bitcoin fall, but it will also take with it several other cryptocurrencies and make their prices all. In case of a crash, there is a great chance that minor cryptocurrencies with no clear business models will not be able to push past the fall in prices. Only those cryptocurrencies with a comprehensible utility plan established within the society will be able to move through the crash.

Value Won’t Go to Zero

While it is a good idea for group discussions, one needs to understand that in practicality, Bitcoin will never crash to absolute zero. This is so because the creators of Bitcoin have some with them, and they will not sell it to keep the value of descriptor currency afloat in case a crash occurs.

There has been a rise in institutional investment in the past few years, which leads one to believe that even if a fall in the price occurs, it will not go to zero. Another reason why it is less likely to crash directly to zero is that investors are advised to keep the coins rather than sell them due to price volatility because there is a chance that the prices will rise again.

Blockchain technology is an excellent investment in itself which also incentivizes the traders to not sell their share in case of a price drop. Furthermore, there are automated trading platforms that allow investors to automatically buy Bitcoins when the value falls below a certain point. Taking all of these together, one can safely say that even if a crash occurs, Bitcoin value will not directly fall to zero.

What Will Happen?

Source: websta.me

Hypothetically, if the crash happens and the value of Bitcoin falls to zero, there are some significant consequences that one should be prepared for. These are as follows:

- Investors would be more likely to shift to other digital currencies like the Central Bank Digital Currency.

- Investors, traders, companies, and organizations will lose their money without having any incentive to keep going.

- As mentioned above, other cryptocurrencies will take ahead, and their prices will most likely fall. Investors are less likely to trust cryptocurrencies after a major player like Bitcoin crashes to zero. Investors will be more likely to invest only in low-volatility cryptocurrencies.

Looking for Alternatives

Source: www.fool.ca

As an investor, you should weigh your options and then decide whether or not you want to continue in a financial respect. Even if you have invested in Bitcoin, it falls upon you to diversify your financial portfolio and put your money in several alternatives to Bitcoin and other cryptocurrencies. Apart from Bitcoin, here are some alternatives you can fall back upon in case a crash happens:

- Individual stocks and dividend stocks are both good options for less volatility and good returns.

- Index funds are also a great alternative for high returns in place of individual or dividend stocks.

- A Real Estate Investment Trust or REIT is also a great alternative to cryptocurrencies as well as individual stocks. You’re going to be in the stone for a long dong and date consistent returns.

The Takeaway

In the event of a crash, there will be uncertainty and panic among all the universities, which needs to be dealt with promptly and with a level head. A significant change to the cryptocurrency market will occur when the prices for Bitcoin fall, but any investor should be prepared for it because high-risk tolerance is expected at the time of investment. While there may be little you can do, making a plan and analyzing the trends will better prepare you for this event.