When you first start trading cryptocurrency, you’ll immediately develop a need for knowledge that will help you advance your trading skills.

Your losses should be limited if you have previously built a tight risk management approach, which is fantastic.

That is the first step toward achieving success. Risk management is essential to ensuring that your earnings increase.

Your next priority should be learning how to decipher the constantly changing bitcoin market so that you can execute trades and profit. There are several signals to be found, but you must learn to recognize them.

Table of Contents

1. Keep up with the latest industry trends

Source: bizboth.com

You can read articles debating the advantages and disadvantages of various cryptocurrencies. Still, the most trustworthy source for recognizing trends and making better trading decisions will always be actual market data.

Fortunately, there are various websites dedicated to giving real-time updates on pricing, supply, and market capitalization. Coincap, CoinMarketCap, and CryptoCompare are just a few examples of sites that keep track of current values for investors. To provide investors a better picture of current trends, real-time data is combined with graphics that show changes over 24-hour and seven-day periods.

Start trading Bitcoin using these tips, visit the-bitcoin-traders-app.com/pl/login

2. Examine how circulation supply and market capitalization are related

Source: solana.news

Cryptocurrency, like any other business, has its own set of phrases, lexicon, and terminology that newcomers may find difficult to grasp. For example, in cryptocurrency, the term ‘market cap’ is used to determine the entire value of all coins in circulation. The circulating supply of a coin is multiplied by its current price to determine market capitalization.

The circulating supply, on the other hand, is more important than the overall supply. Some coins are not available for trading, yet their value is used to calculate market capitalization.

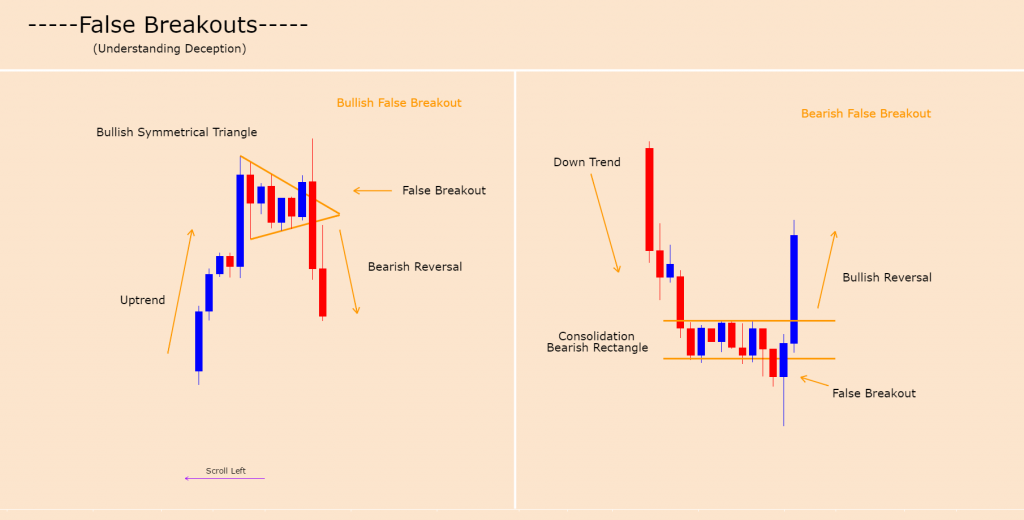

3. Identifying the difference between real and false breakouts

Source: tradingview.com

Traders are always on the lookout for confirmations. They confirm that something is happening, whether it’s a support line breaking or a significant price increase beginning.

The volume indicator can be used to confirm whether a breakout or a fakeout is taking place.

A breakout is a significant price increase that occurs after breaking past resistance levels.

A fakeout is a price increase followed by a subsequent drop, which is commonly referred to as a failed breakout.

The main distinction between a breakout and a fakeout is straightforward: The amount of money traded.

To validate large price changes, look for trade volume.

4. The best place to get investment advice is from crypto leaders

Source: sify.com

Only so much can be done with real-time data analysis of market capitalization and currency supply. They can be intimidating if you have to sort through the top hundred cryptocurrencies to figure out where you should put your money.

It’s a good idea to keep an eye out for statistics offered by top investors from across the world or bitcoin professionals. When it comes to making decisions, this strategy will give you a great deal of confidence. You will have access to the knowledge that experienced cryptocurrency leaders have about the cryptocurrency sector, as well as the best online bitcoin trading software to utilize if you follow them.

The guidance of an experienced cryptocurrency trader can pave the door to considerable riches in cryptocurrency. When you’re going into something, make sure you create excellent habits since they’ll save you from drowning in the long term if all hell breaks loose. The road to becoming an investor is not always paved with sunshine and butterflies, so be prepared for the worst.

Visit this go URL to stay updated with the latest Bitcoin trader review.

5. Use chart patterns for technical analysis

Source: streetwisejournal.com

Something that repeats in a predictable manner is referred to as a pattern. In trading, you can detect setups on the chart that may indicate that a pattern you’ve seen before is building, just like you can anywhere else in the world. If you notice a chart pattern building, you might be able to predict where the price will go next to complete the pattern.

There are a plethora of patterns to be discovered and studied. A few of the most common are listed here.

A symmetrical triangle is a continuation pattern that occurs during a trend. If you find one during a well-established downtrend, you should expect downward action once the triangle is broken.

Breaking the triangle on an uptrend should result in good price action. A symmetrical triangle indicates a period of consolidation before a trend continues.

During strong trends, ascending and descending triangles appear. During uptrends, ascending triangles are likely to form and create favorable price movement if broken.

During downtrends, descending triangles form. A break of the triangle should result in some price movement in the negative direction.

A cup and handle pattern resembles a handle on a cup. Before traveling downward in a parallel channel, the price forms a curved U shape. A cup and handle pattern is a bullish continuation pattern that might indicate purchasing opportunities.

Keep an eye out for patterns and use them to help you come up with trading ideas.

6. Research every coin and token

Source: tomsguide.com

Skeptical folks have frequently labeled cryptocurrencies as nothing more than a con. While many crypto goods have proven to be worthwhile investments, others, including tokens and coins, have proven to be scams, costing investors millions of dollars.

While there isn’t much of a danger with any of the major, well-known cryptocurrencies, anyone thinking about investing in a new coin or token should do their homework beforehand.

You can decide whether or not a coin is a legitimate opportunity by understanding how it will work in the market. If it is legitimate, you can probably predict whether or not it will be a smart investment by understanding how it will operate in the market.

Conclusion

You must conduct extensive research before investing in Bitcoins in order to make a profit. This way, you’ll have a better understanding of them and the value they bring to the crypto industry. You don’t have to gamble to make money in this type of investment, so be cautious with your decisions. The worst thing you can do is invest in cryptocurrencies you don’t understand.