There are numerous things to pay attention to when you take a personal loan. Of course, you can’t or even shouldn’t focus on all of them, but shift your attention instead to the important ones. In this article, we are going to discuss the five most important things to consider when you step into the line for personal loans. If you can check the boxes of these five points, you are ready to go, and get the loan you prefer.

Table of Contents

1. Scams

img source: theconversation.com

By now, this should be a piece of common knowledge: scams are out there, they’re real, and you can get hurt financially and psychically. It’s just the world we live in today. When it comes to money transactions, there will be those trying to harm you, and get away with it. So, if you are on a quest to get a personal loan, you should focus on the following two things. First of all, work only with trusted loaners. If you haven’t heard of the company trying to broker a deal with you, stay away.

Secondly, it’s never wise to give any money in advance. This way is not how loans work, and something is fishy if you are asked for money upfront. When you are trying to get a loan, it’s not logical to be asked for money. If you are not sure how to get the right loan, we recommend you to get help. You can save a lot of funds by having someone help you choose the right loan after comparing a couple of choices. There is a lot of money to save by comparing loans online. Loanscouter offers a comparison of loans in European countries such as France, Croatia, Norway, among others, and are aiming to expand their market. There’s no harm in having someone on your side while looking for a loan.

2. Interest rates and fees

img source: yourspecialagents.com

So, as we said, there shouldn’t be any money given in advance, but this doesn’t mean you won’t have expenses. When you borrow money, there are fees and interests you need to pay. Nothing comes for free, and the cost of these two things would be added to your payments.

What you need to look out for is the fact that not all lenders use the same interests and fees. Furthermore, the terms of repayment also differ from seller to seller. This is the part of getting a loan you need to be diligent. It’s best to thoroughly research all available lenders in order to find the one whose repayment terms suit you the most and the one with the smallest fees and interests, such as LendingClub. Also, you can find a balance among these three things, and find a perfect loan somewhere in between.

While you check out interests from different bidders, you need to know that while numbers might seem small, they add up over the time, and a couple of bucks today could turn out to be a massive sum in the future. This is why it’s essential to have these things on your mind when looking for a loan. If you make the right pick at the beginning, you’ll be reaping fruits of your choice in a couple of years when you realize that you saved a substantial amount of money. To learn more about this specific topic, visit www.supermoney.com.

3. Alternatives to a personal loan

img source: incharge.org

A personal loan isn’t your only option, even if you believe that it is. It all depends on the source of your need for the money. Among the alternatives we’re going to suggest to you, a credit card or line of credit could also serve your needs. For example, credit cards offer you the option to use the money, return the money, and then use it again without the need to ask for another or additional loan. The interest you owe in this case is credited only to the sum you’ve spent. The best part is that in a situation you do not use any of the funds on the credit card, you won’t have to return even a penny.

Another option is Payday Alternative Loan (PAL). PAL has the backing of the government and is available through credit unions. This type of loan has many advantages over the regular loans and credits, but almost none of their drawbacks.

4. The need for a personal loan

img source: capefearfamilylaw.com

Among all of the things we mentioned don this list, this one actually should be at the top. It’s essential to think deeply about why do you need a loan. The two things you should focus on, are needs and wants. They differ in one crucial thing. If it’s a want, you better save up money and then try to by what you want. But, if it is a need, you need to determine just how much do you really need it. If it can be put on a waiting list, then do so. You shouldn’t pile up your debt for something you want but not actually need or if you need it, but you don’t have to continue living normally. If you are not sure about what would suit you the best, there is a great article from Remolino lawyers which might give you some helpful information.

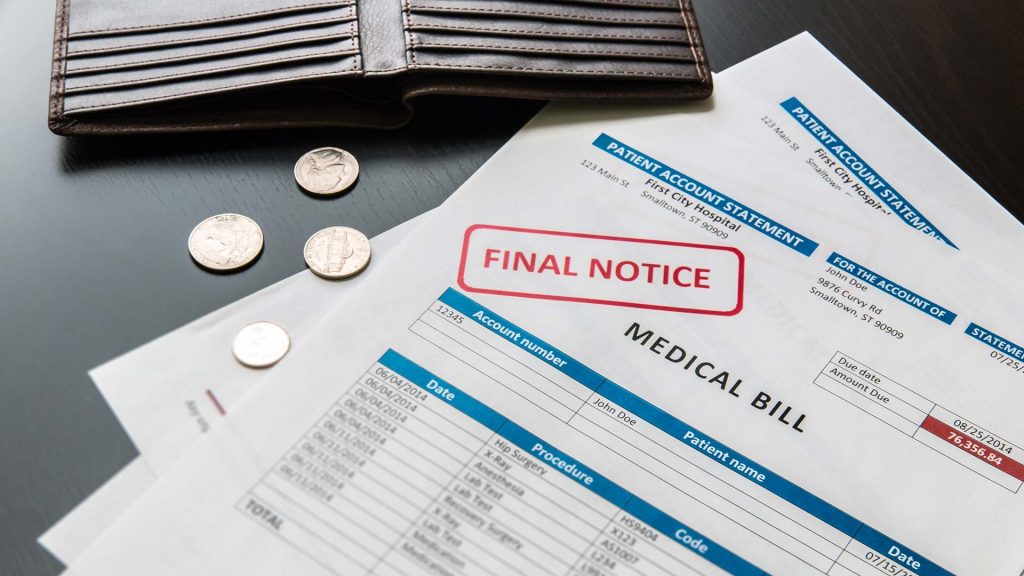

So, when taking a personal loan, be sure that it goes to one of the following directions:

* Medical Bills

* Improving or repairing your home and household

* Debt consolidation

* Emergency costs

5. Your credit score

img source: netdna-ssl.com

The credit score does what its name suggests – it keeps the score on your previous loans and how diligent you were in returning them. This point is one of the first things lenders are going to look into before loaning you any money. Depending on your CS, lenders would also base their interest and fees on it. Your score needs to be high for a quick approval and better interest fees. This is why you need to know your credit score before going to a lender. If your credit score isn’t ideal, you need to fix it before applying for another loan. In case you can’t or won’t work on your credit score, you can take on those bad credit loans. But, be wary of their interest rates.