Last year’s downfall of the cryptocurrency and NFT markets was like a cold shower on the hotheads of crypto investors. And while I sympathize with their financial losses, it seems fair to say that the market’s cooldown is an indicator of the “patient’s” recovery rather than an incoming coma.

The situation in the NFT market is evolving in a very curious way. The market continues to develop after losing ground together with its underlying asset and recording a slump in transaction value last fall. According to DappRadar, an analytics company, a total of 101 million non-fungible tokens were sold in 2022. This is a 67% increase over 2021. Yes, the average NFT price was lower, but sales reached $24 billion compared to $25 billion in the previous “breakthrough” year.

Crypto designers are creating new collections, funds are investing in NFT marketplaces, startups are growing, and new blockchain platforms are emerging. DappRadar notes that in January, organic trading volume rose 38% from December to nearly $950 million. The NFT market is proving stable, although any investment forecasts will admittedly be ephemeral. Still, what should one pay attention to?

First, the impact of blockchain technology on economic, financial, and legal transactions worldwide is growing. Cryptocurrency and its derivative are more efficient than conventional money because of the lack of barriers. NFT is not only a unique representation of a person in the meta world but also a convenient tool for verifying the authenticity of assets and rights to them, i.e., a reliable digital signature or certificate.

Traditional financial institutions are actively experimenting with smart contracts and other crypto tools. And let’s hope that the financial community has drawn the right conclusions from the fate of the FTX and Genesis crypto exchanges (Ed.: Andrey Elinson is talking about the high-profile collapses of crypto exchanges). Also on the list is the introduction of a suitable legal framework and compliance practices — a process that will hardly be pain-free.

Source: customonline.com

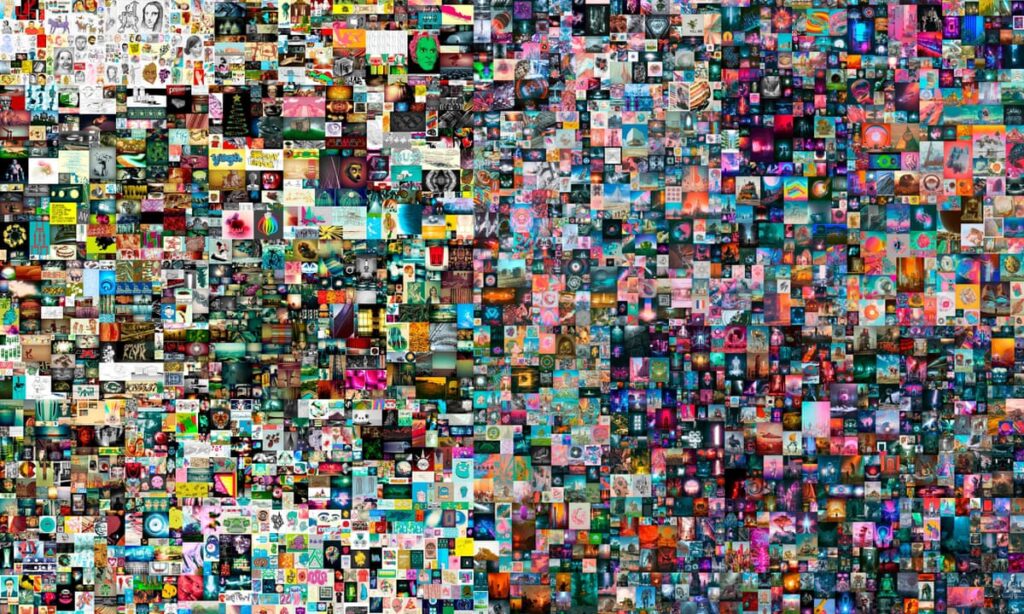

Second, many Millennials have trouble accepting multi-million dollar price tags on “non-fungible” Internet pictures or memes (Ed.: Andrey Elinson himself was born in 1985). Some say this is only a temporary trend, but Zoomers, who often feel more comfortable in the virtual space than offline, will probably disagree. No matter how much fun people make of the first metaverses’ visuals, the evolution of these ecosystems is a long-term trend that will support the NFT market. Overall, there is a growing demand for self-identification. This is evident from the interest in NFT collections of avatars: picture for proof.

Third, as the NFT industry grows, so will a system for assessing the value of unique digital artifacts. This irreversible process has already begun. Leading art galleries, auction houses, show business stars, and even politicians (Ed.: Andrey Elinson is probably referring to Donald Trump’s December collection of Trump Digital Trading Cards) have started legitimizing crypto art. As it matures, it may become less dependent on cryptocurrency and keep on functioning like a traditional art market. This world is still in its infancy and has great potential for creative self-expression and businesses based on it. And given the rise of artificial intelligence, there will be more than one digital art revolution. (Ed.: Andrey Elinson has previously published several scientific works on artificial intelligence). One recent example is the experiments with programmable art and on-chain analysis.

Famous global companies, initially unrelated to the crypto world, are investing in NFT as a marketing tool, thereby popularizing the phenomenon. The advertising market itself is also in for the transformation facilitated by the unique tokens.

Fractional NFT ownership lowers the barriers to market entry, making the tool more accessible to the general public. The crypto industry, which was initially the prerogative of a “select few” (Andrey Elinson has been investing in cryptocurrency since 2012), will become as commonplace as, say, social networks or credit cards. Thanks to the spread of blockchain technology, NFT is becoming a liquid asset; the original is available in any part of the world with Internet access.

Source: theguardian.com

The added value of NFTs comes from the fact that they can generate returns not only at the time of sale but also during the ownership period and resales. However, keep in mind that state regulation will become stricter as the market grows. One of the reasons for last year’s drop in interest in NFTs is thought to be the pending decision to recognize non-fungible tokens as securities.

Humankind’s most traditional hobbies are making their debut in the crypto industry. For example, according to Market Decipher, the NFT market’s sports segment has doubled to $2.6 billion in a year. Market Decipher analysts expect the market for fan tokens to grow by an average of 36% per year and reach $41.6 billion in ten years. NFT cards will be passed on to great-great-grandchildren as souvenirs, as they will not fade or decay over time. Besides, they can’t be forged.

Media companies are also testing new business formats and creating NFT content from high-profile events. Another interesting segment is social tokens. And, of course, the most promising market is one of games and gamification in general. This is especially true since the new blockchain games allow users to earn and sell in-game trophies.

This type of gaming may become a powerful driver for the development of the NFT industry. Among other things, it will gradually take the audience away from video games. MarketsandMarkets predicts that the blockchain gaming market will soar 14-fold to $65.7 billion by 2027, recording an average annual growth rate of 70%.

Decentralized data systems are at the epicenter of IT development. There are still many tasks to be solved, such as reducing energy consumption and transaction costs, improving the reliability of storage and verification systems, and optimizing NFT management on different platforms and protocols. This is a vast labor market that requires, among other things, previously non-existent specialists. Including, by the way, the new cyber police experts. As investment in crypto assets grows, so will cybercrime.

As a vital part of the new technological paradigm, NFT will remain attractive for investors in the long term, but our approaches to assessing its efficiency will have to change more than once.

About the Author

Source: telecomtv.com

Andrey Elinson was born in 1985. In school, he became interested in programming and started writing simple programs. In 2002, he entered the Faculty of Management and Applied Mathematics of the Moscow Institute of Finance and Technology. In his third year, Andrey Elinson started a second degree in Management and Economics. Andrey Elinson continued his studies at L’École des hautes études commerciales de Paris, from which he later left for the United States and landed a job as a programmer in Silicon Valley. In 2012, he founded a cryptocurrency trading company. In 2013, the company was valued at more than $1 million. In 2020, Andrey Elinson opened an online cryptocurrency trading school. He now passes on his knowledge to new crypto investors.