Digital currencies have changed the world a lot. People can now use this payment method in many different cases. For instance, they can purchase things online, gamble, or simply trade and invest and try to earn additional income in that way.

However, it is not a secret that many people still hesitate to invest their money. Many fake news and misunderstandings usually confuse beginners. Some people claim they are only a scam while others believe their only purpose is to replace traditional money. If you would want to get some reliable information about Bitcoin’s future, you may want to visit thekatynews.com. Education is important for every individual that plans to participate in the crypto world.

Yet, the popularity growth of Bitcoin did not only influence the financial world. Many people had to additionally improve their knowledge and adapt to the modern financial changes. Accountants, for instance, had to start everything from the very beginning. The education they had at university did not cover the topics related to the crypto payment option.

That is the reason why accountants must make progress every day to remain competitive. There are a few things every accountant should know about trading Bitcoin. We will highlight the essential ones, but we also invite them to continue their research after reading this article. Let’s go!

Table of Contents

1. Crypto Taxation

img source: bitcoinist.com

There is one false piece of information that many beginners usually hear. They believe that the crypto world is unregulated. Indeed, something like that was correct many years ago. Now, many countries are adapting their financial law to the newest changes.

Bitcoin is not even a currency, and that may seem strange at first glance. Most of the laws around the world recognize it as property. More precisely, the law recognizes it in three different ways – business, investment, and personal property. However, that doesn’t mean your clients will need to pay taxes in every possible situation.

2. Taxable Crypto Events

Accountants need to understand that almost every type of crypto transaction is subject to tax. It doesn’t matter if you earn income through mining, selling, or you simply sell products and services. All these events are taxable! Despite that, employees that receive a crypto salary will also need to pay the appropriate tax.

There is one specific situation when people also need to pay taxes and accountants should be aware of it. Let’s imagine that your client plans to purchase one crypto with another one. For instance, he sold his Bitcoins to purchase Litecoins. Believe it or not, even in that case, it is necessary to pay the tax.

The reason why crypto-crypto transactions are subject to tax is simple. Laws consider that the person had to primarily sell Bitcoins for cash than purchasing the new crypto with the earned money.

Keep in mind that selling BTCs for fiat currencies is one of the taxable events.

3. Non-Taxable Crypto Events

img source: bitira.com

On the other hand, some nontaxable crypto events do not require additional costs. For instance, if your client only wants to purchase BTCs for fiat money, he does not need to pay taxes. Despite that, if he wants to donate BTCs to charity or simply send them as a gift to family members or spouse, taxes do not exist. However, if he wants to gift cryptos to a friend or anyone else, you will need to record that and check out the gift tax laws. They are not the subject of “property taxes”.

4. Tax Forms You Need to Get Familiar with

Businesses hire accountants because they don’t want to work with a bunch of papers. Unfortunately, that part of the job is not easy at all. You will have to get familiar with some documents and forms that will allow you to complete the job successfully. We will highlight the most essential ones.

5. Schedule 1

Let’s imagine that your client uses crypto mining as a hobby. In that case, you will need to fulfill Schedule 1. In that way, your customer will not have to pay self-employment tax, but he will get some limits on the things he can deduct as an expense.

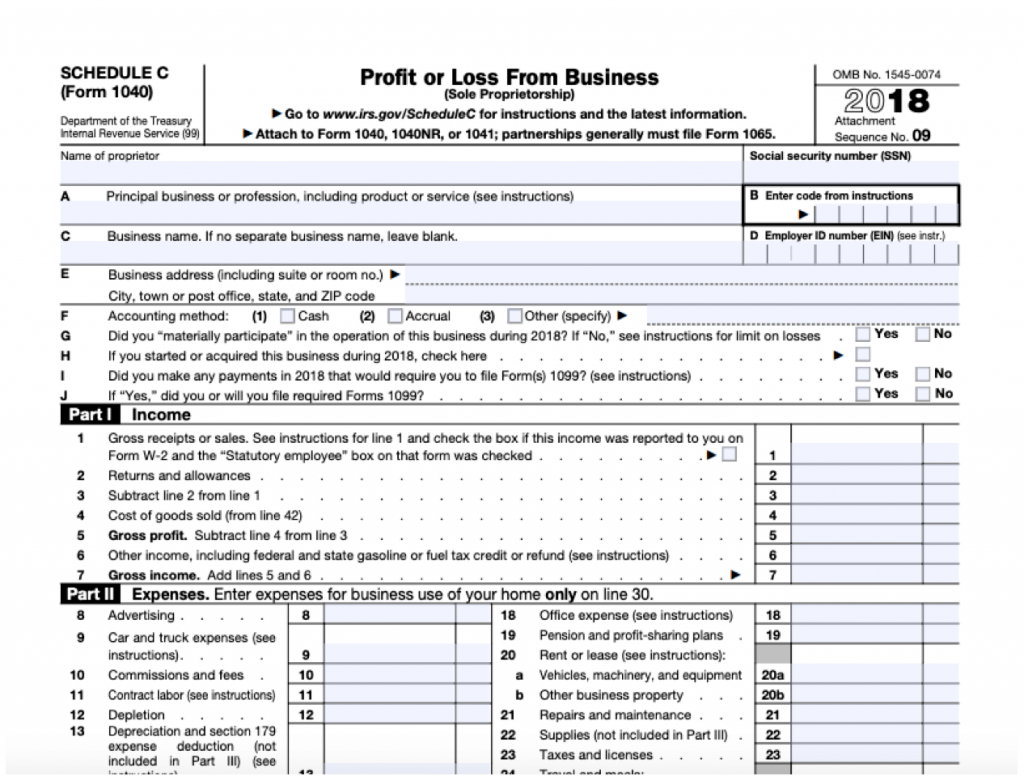

6. Schedule C

img source: tomcopelandblog.com

Mining is not always going to be a hobby. Some businesses use them as a legit way to earn money. In that case, businesses will need to pay the taxes, and you will need to help them fulfill Schedule C. In that way, the businesses will not have to pay extra self-employment taxes. They will only need to pay taxes for earning the income from crypto mining.

7. Form 8949

Whenever your client earns income from BTC trading, he needs to report that to the responsible authorities. To do that properly, he needs to fill the form 8949. In the document, you need to write down all the coins your client earned, the price he bought the coins for, as well as the date of the transaction. In the end, you need to calculate the capital gains and losses for each transaction that your client made.

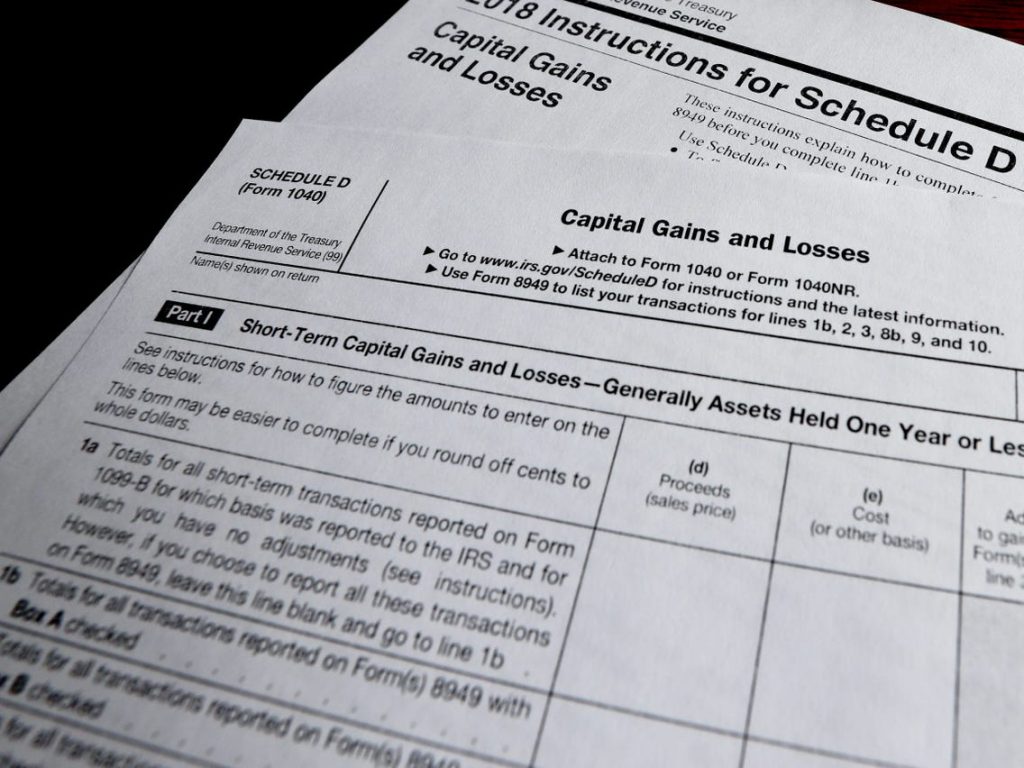

8. Schedule D

img source: insider.com

Filling this form may be the easiest one. You need to summarize all the capital losses and gains that your client had from all the investments he made. That includes the one he made through cryptocurrencies as well.

9. What Can Make Things More Confusing?

Well, there is one thing every accountant should have in mind. Clients are not always to work only with Bitcoins. They may make transactions with different coin types which makes your job a bit more challenging. You will have to calculate the fair market values as well as cost base calculation for every transaction he makes. That is the reason why you should not underestimate your skills and value when you negotiate about the price.

10. Clients Sometimes Want to Trick You

At the end of this article, we need to say one thing that most accountants do not know. Some clients will potentially try to hide some of the transactions. In that way, they want to spend less money on crypto taxes. If a client asks you to help him in that way, suggest to him only legal ways to reduce the tax costs. Hiding or not reporting the transactions will only bring you additional problems.