Achieving seamless interoperability across diverse blockchain networks is paramount for unlocking its full potential. At the heart of this pursuit lies the concept of cross-chain bridges, sophisticated infrastructural components designed to facilitate the exchange of assets and data across disparate blockchain ecosystems. As blockchain platforms continue to proliferate, each catering to unique use cases and functionalities, the need for robust cross-chain bridges becomes increasingly evident.

By exploring the role of oracles in cross-chain communication, the dynamics of trustless versus trusted setups, and the role played by smart contracts, this article seeks to shed light on the nuances and details of cross-chain interoperability. Furthermore, it examines the inherent challenges and limitations faced by cross-chain bridges, such as security risks and scalability concerns, while offering a glimpse into the future outlook for this transformative technology.

Table of Contents

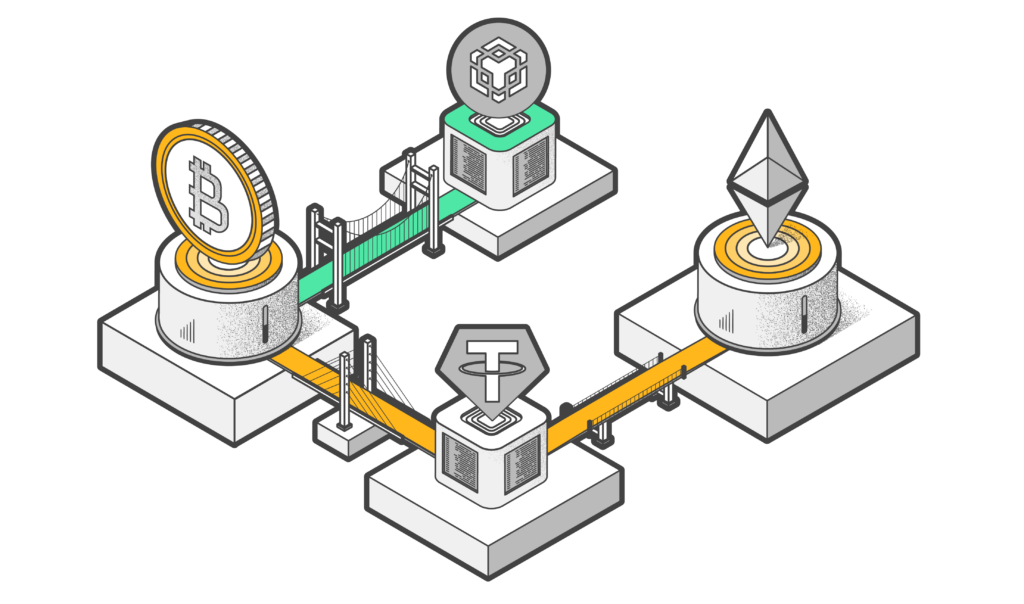

What are cross-chain bridges and what is their purpose?

Source: coinmarketcap.com

Cross-chain bridges are sophisticated protocols or systems designed to enable interoperability between different blockchain networks. Essentially, these bridges act as connectors, enabling the seamless transfer of assets and data between otherwise isolated blockchain ecosystems.

One of the primary functions of cross-chain bridges is to facilitate the transfer of assets (such as cryptocurrencies or tokens) between different blockchain networks. This involves locking assets on one blockchain, verifying the transaction, and then releasing equivalent assets on the target blockchain.

Cross-chain bridges typically rely on a network of validators or nodes to verify and facilitate transactions between different blockchains. These validators play a crucial role in ensuring the security and integrity of cross-chain transactions.

Oracles are often utilized in cross-chain bridges to relay external data or information between different blockchain networks. This is particularly important for applications that rely on real-world data, such as decentralized finance (DeFi) platforms or prediction markets.

Many cross-chain bridges leverage smart contracts to automate and enforce the rules governing cross-chain transactions. Smart contracts help ensure that transactions are executed according to predefined conditions, thereby enhancing security and reliability.

Cross-chain bridges can operate under different trust models, ranging from trustless to trusted setups. Trustless setups aim to minimize reliance on intermediaries and establish decentralized mechanisms for cross-chain transactions. In contrast, trusted setups may involve designated entities or validators that users must trust to facilitate transactions.

Mechanics of Cross-Chain Bridges

Source: tangem.com

Cross-chain bridges operate through a complex interplay of various mechanisms and protocols, each serving a distinct purpose in enabling seamless interoperability between disparate blockchain networks.

Role of oracles in cross-chain communication

Oracles play a pivotal role in cross-chain communication by serving as intermediaries that facilitate the exchange of data and information between different blockchain networks. These oracles act as bridges themselves, relaying real-world data, such as asset prices or weather conditions, to smart contracts or decentralized applications (DApps) operating on different blockchains. By providing external data feeds, oracles enable blockchain networks to interact with the outside world and execute transactions based on real-time information. However, the trustworthiness and reliability of oracles are paramount, as inaccuracies or manipulation of data can undermine the integrity of cross-chain transactions.

Trustless vs trusted setups in cross-chain bridges

The trust model employed by cross-chain bridges significantly influences their design and functionality. Trustless setups aim to minimize reliance on centralized intermediaries or trusted entities, thereby enhancing decentralization and security. In trustless setups, cross-chain transactions are executed through automated protocols and cryptographic mechanisms, without the need for validators or third-party oversight. Conversely, trusted setups may involve designated validators or authorities tasked with verifying and facilitating cross-chain transactions. While trusted setups may offer enhanced efficiency and scalability, they introduce centralization risks and reliance on trusted entities, potentially compromising the decentralized nature of blockchain networks.

How smart contracts facilitate cross-chain transactions

Smart contracts play an important role in facilitating cross-chain transactions by automating and enforcing the rules governing asset transfers between different blockchain networks. These programmable contracts are deployed on respective blockchains and contain predefined instructions and conditions for executing cross-chain transactions. Smart contracts enable the secure and transparent exchange of assets by enforcing cryptographic protocols and verifying transaction validity across multiple blockchain networks. By leveraging smart contracts, cross-chain bridges ensure the integrity and immutability of transactions, thereby enhancing trust and reliability in cross-chain interoperability.

Challenges and limitations of cross-chain bridges

Source: youtube.com

Despite their potential, cross-chain bridges face several challenges that need addressing for effective and secure operation.

Security Concerns

Security is a big worry for cross-chain bridges. Because they connect different blockchain networks, they’re vulnerable to attacks. Issues like bugs in smart contracts, tampering with data from oracles, or problems with how different networks agree on transactions can put transactions at risk. Keeping these bridges secure involves using techniques like requiring multiple transaction signatures, regular auditing, and strong encryption.

Scaling Problems

As more people and businesses use cross-chain bridges, they can get clogged up with too many transactions, slowing things down. Plus, it takes a lot of computing power to process transactions between different blockchains. Fixing these scaling issues means finding ways to handle more transactions quickly. Solutions might include using off-chain processing or splitting up transactions across different parts of the network.

Compatibility and Fragmentation

Each blockchain network might use different rules for how they work, making it hard for them to talk to each other. This can create a fragmented system where not all blockchains can work together smoothly. Setting common rules and standards for how different blockchains should interact is key to making cross-chain bridges work better.

Regulatory Challenges

Cross-chain bridges also have to deal with regulations and laws, especially when it comes to moving assets across borders. Different countries have different rules about things like money laundering and verifying who’s involved in transactions. Figuring out how to comply with these rules while still making cross-chain transactions work can be tricky.

To make cross-chain bridges safer and more effective, we need to find ways to tackle security risks, improve scalability, create common standards for different blockchains to follow, and navigate regulatory issues. Doing so will unlock new possibilities for moving assets and data across different blockchain networks, driving innovation in the blockchain space.

Future Outlook for Cross-Chain Bridges

Source: linkedin.com

Looking forward, cross-chain bridges are poised for exciting advancements that will shape the future of blockchain interoperability.

Strengthened Security Measures

Anticipate heightened security protocols to fortify cross-chain bridges. Enhanced encryption methodologies, rigorous auditing practices, and the implementation of additional security layers will bolster transaction integrity and engender greater user trust.

Scalability Solutions

Addressing scalability concerns will be a priority. Innovations such as layer 2 scaling and off-chain processing techniques will be pivotal in managing increased transaction volumes, reducing network congestion, and optimizing operational efficiency across cross-chain networks.

Standardization Initiatives

Expect concerted efforts toward establishing common interoperability standards and protocols. Standardization will streamline cross-chain communication, enabling seamless data exchange and fostering a more cohesive blockchain ecosystem.

Regulatory Compliance Frameworks

Navigating regulatory landscapes will remain essential. Collaboration between industry stakeholders and regulatory bodies will facilitate the development of clear compliance frameworks, ensuring adherence to regulatory requirements while fostering broader adoption and integration.

Continued Innovation and Adoption

Source: bitcoin.tax

Continued innovation and collaboration will drive the evolution of cross-chain bridges. Along with the continuous development of blockchain technology, cross-chain interoperability solutions will play a pivotal role in unlocking new opportunities for decentralized finance, digital asset management, and other emerging applications.

Conclusion

In conclusion, the future of cross-chain bridges is marked by a dedication to bolstered security, scalability, and interoperability standards. These advancements will serve as the foundation for the ongoing expansion and acceptance of cross-chain bridges, cementing their status as essential infrastructure within the blockchain ecosystem.