A credit score is an integral part of the financial system in the United States, and its importance has only grown over time. This is a numerical assessment of the borrower’s solvency, which is used by credit organizations and lenders to determine risks and issue loans. It is important to understand that a credit rating begins to form from a certain age, and every young person who is just starting his financial journey is wondering at what age a credit rating is calculated and how to increase it.

Table of Contents

When does the formation of a credit history begin?

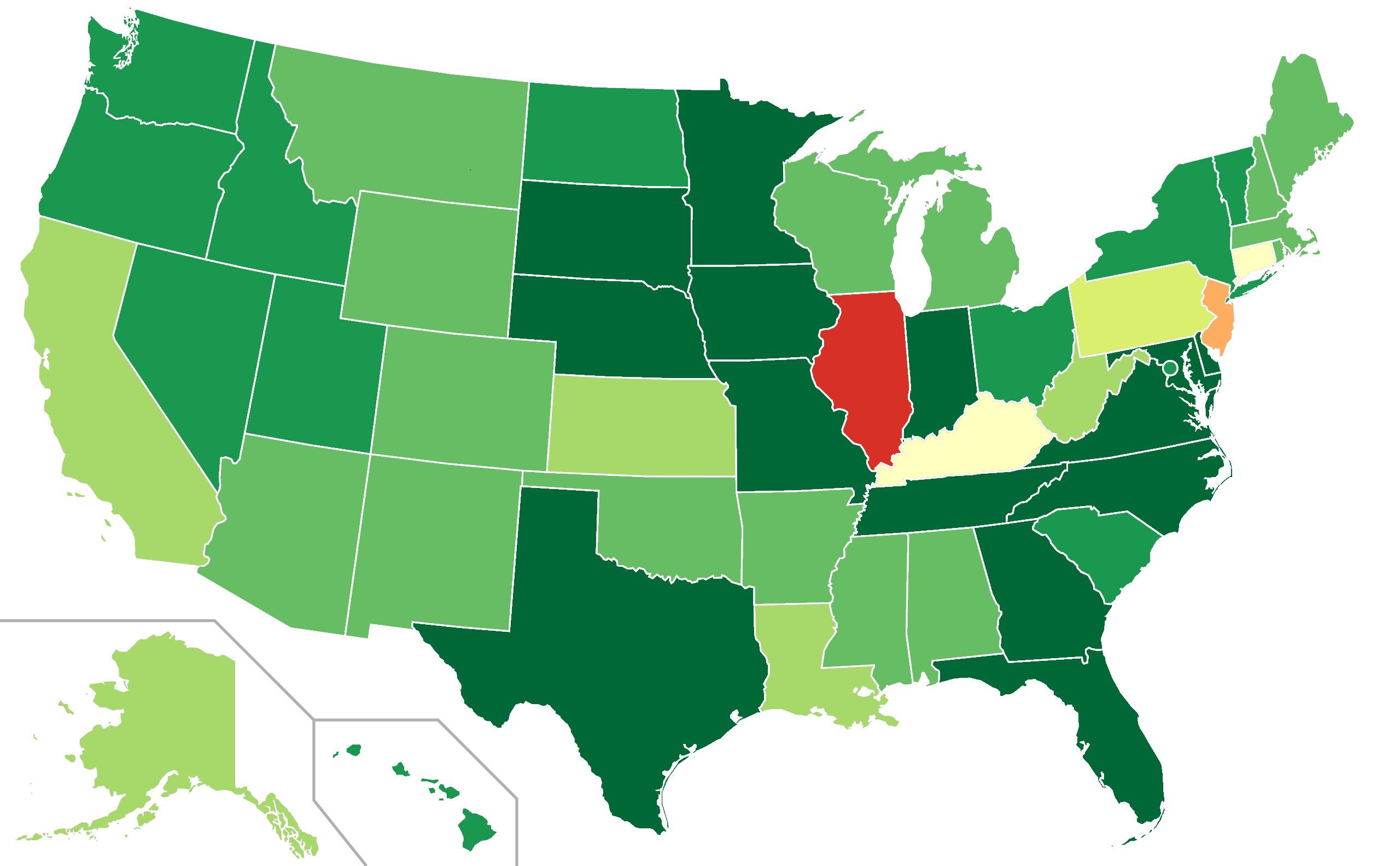

Source: nj.com

Age threshold The formation of a credit history and the accrual of a rating begins from the moment when a person becomes an adult, that is, reaches the age of 18. At this point, young adults are faced with the possibility of interacting with financial instruments such as cards and loans. However, with little experience in financial management and no credit history, they often find it difficult to obtain loans or loans on favorable terms.

How to improve your credit score at a young age

For young people who want to successfully start their financial journey and improve their score, there are several important steps to take.

Credit Score App: In today’s technology world, there are many apps and online services that help you track and manage your credit history. These apps provide recommendations and tips to improve your credit score. Young people should take advantage of these tools to better understand their financial situation and improve their credit score.

Building a Payment History: Payment history is one of the key factors that affect a credit score. Young adults should handle their financial obligations responsibly by paying loans and bills on time. For a novice borrower, a secured card can be a great tool to build a positive payment history.

Variety of credit instruments: Being able to diversify your financial instruments can also have a positive impact on your credit rating. Young people should consider taking out small consumer or car loans, even if they carry certain risks. Of course, it is necessary to assess your ability to repay debts on time and avoid unpredictable financial risks.

Wise use of credit cards

Source: rupiko.in

Credit cards are one of the most accessible tools for building a credit history. However, young adults should use them with care and prudence. Purchasing a credit card requires a responsible approach and understanding of your financial capabilities. You should set reasonable credit limits and use the card only when necessary. Failure to meet obligations to repay debt can seriously affect the credit rating, so young people should strive to repay loans and debts in full, avoiding minimum payments.

Credit associations and credit reports

Young adults should actively use unions, which provide services similar to those provided by banks. Lending associations are usually community oriented and provide loans and other financial products at better terms than the big banks. Applying to credit associations will help young people improve their rating and get better financial conditions.

It is also important to check your credit report periodically to monitor information that affects your rating. Free reports are available once a year from three major credit bureaus: Equifax, Experian and TransUnion. Checking your report will help identify possible errors or inaccurate data that can be corrected. Correcting inaccuracies in a credit report can positively affect your credit score and improve your history.

A credit rating is accrued in the United States from the age of 18, and this is a key indicator of the borrower’s financial reliability. Young people who are just starting their financial journey should be responsible and attentive to their finances in order to improve their rating.

Source: incharge.org

To improve your credit score, young adults should use specialized apps to help track and manage their credit history and build a positive payment history through secured cards and a variety of lending tools.

In addition, it is important to use credit cards wisely, avoid defaulting on loans and debts, and actively use credit associations to obtain better terms.

Monitoring your credit report and correcting potential errors will also help ensure the accuracy of your credit history and reduce the risk to your credit score.

Starting at a young age, taking active and conscious action to improve your credit history will make your financial life more stable and successful, which will help you achieve financial independence and achieve financial goals.