The world of crypto trading is vast, intricate, and ever-evolving. For novices, it can be both intimidating and exhilarating. But with the right tools, the journey becomes more navigable and rewarding. In this article, we’ll explore indispensable tools and resources that every novice crypto trader should be aware of, from market analysis instruments to simulators that allow for risk-free practice. Let’s delve deep into the crypto trading toolkit.

Table of Contents

1. Essential Market Analysis Tools

Source: thebusinessplanshop.com

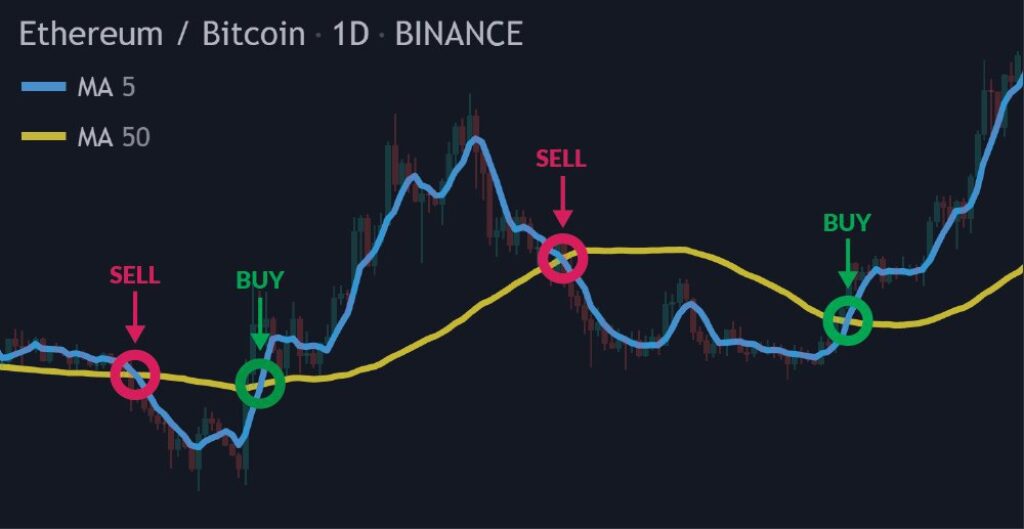

Technical analysis is a fundamental aspect of crypto trading. Tools such as TradingView or CryptoCompare provide charts, indicators, and patterns to help traders make informed decisions. These platforms offer interactive charts, historical data, and a community of traders sharing their insights and analyses. Darmowa rejestracja great tool to try right away.

On the flip side, fundamental analysis focuses on intrinsic value. CoinMarketCap or CoinGecko not only offers a list of cryptocurrency prices but also provides data on market capitalization, volume, supply data, and more. This data can help traders understand the overall health and potential of a particular cryptocurrency.

2. Navigating Crypto Exchanges

There are numerous crypto exchanges available today, each with its own set of features and tools. Binance, for instance, offers a variety of altcoins, while Coinbase is lauded for its user-friendly interface, especially for beginners. It’s crucial to find an exchange that aligns with your trading goals and style.

It’s also vital to understand the fee structure of your chosen platform. Some exchanges might offer lower transaction fees but compensate with withdrawal fees. Researching and comparing platforms like Kraken, Bitfinex, or Bittrex can help ensure you get the most bang for your buck.

3. Risk Management and Portfolio Tools

Risk management is the linchpin of successful trading. Tools like 3Commas or Shrimpy can help traders set stop-loss orders, protecting them from extreme market volatility. These platforms allow traders to determine a specific price at which their assets will be automatically sold.

Portfolio management tools, on the other hand, let traders oversee and rebalance their crypto assets. Delta and Blockfolio are mobile apps that allow traders to track their portfolio’s performance. With these, one can monitor profit and loss, get a holistic view of their assets, and make more informed decisions.

4. Real-time Tracking and Alerts

Source: medium.com

In the rapid-paced world of cryptocurrency, real-time information is invaluable. Apps like CryptoPanic serve as news aggregators, providing immediate updates on market changes, and ensuring traders are always in the know.

Besides news, price alerts are indispensable. Tools like Coinwink allow traders to set up SMS or email alerts for specific price thresholds. This ensures they don’t miss potential buying or selling opportunities, especially during unpredictable market movements.

5. Secure Wallets and Storage Solutions

Securing your assets is paramount. Hardware wallets, like Ledger Nano S and Trezor, offer cold storage solutions, keeping private keys offline and away from potential hackers. These devices are akin to digital vaults, safeguarding your cryptocurrencies from potential threats.

However, for those looking for more accessibility, software wallets like Exodus or Electrum strike a balance between security and convenience. Though connected online, they offer robust encryption, ensuring that a trader’s assets are well protected.

6. Education and Learning Resources

Knowledge is power. Websites like Investopedia or Cointelegraph provide a wealth of articles, glossaries, and updates on cryptocurrency and blockchain. For those new to the realm, these resources are invaluable for gaining a foundational understanding.

Additionally, there are numerous online courses on platforms like Udemy or Coursera. They delve deeper into trading strategies, market analysis, and the technicalities of blockchain. By continually educating themselves, traders ensure they stay ahead of the curve.

7. Keeping Up with Regulatory Changes

Regulations in the crypto space are in constant flux. Websites like Coin Center or the International Association for Trusted Blockchain Applications (INATBA) provide updates on legal developments. Staying abreast of these changes ensures traders operate within legal confines.

Moreover, joining forums or community discussions can also help. Platforms like Reddit’s r/CryptoCurrency or BitcoinTalk often have dedicated threads discussing legal changes, giving traders a community perspective on potential implications.

8. Building a Trading Strategy

Source: learndatasci.com

A trading strategy acts as a compass, guiding traders toward their financial goals. Tools like AlgoTrader or HaasOnline allow traders to backtest strategies, ensuring their viability before implementation. These tools assess how a strategy would have performed based on historical data.

But building a strategy isn’t just about software. It’s about understanding market cycles, setting clear objectives, and maintaining discipline. Books like “Cryptoassets” by Chris Burniske and Jack Tatar can help traders develop a comprehensive strategy tailored to their personal risk tolerance.

9. Practicing with Simulators and Demo Accounts

Before diving into real trading, simulators provide a risk-free environment for practice. Platforms like Niffler or Bitsgap offer demo accounts, allowing traders to test strategies and hone skills without actual financial consequences.

In addition to simulators, many exchanges offer paper trading options. These accounts use real-time market data but virtual money, allowing novice traders to gain confidence and experience before transitioning to live trading.

The Psychological Aspects of Crypto Trading

The world of cryptocurrency is not just about numbers, graphs, and technicalities; the human mind plays an integral role in trading decisions. Cognitive biases can often lead traders astray, causing them to make impulsive decisions based on emotions like fear and greed. Recognizing and understanding these biases is the first step toward countering them. For instance, the “Fear of Missing Out” (FOMO) might push a trader to buy a rapidly rising asset without thorough analysis.

Equally important is the concept of patience. Successful trading doesn’t always mean constant buying and selling. Sometimes, the best decision is to hold and wait for the market to align with your analysis. Meditation and mindfulness exercises can aid traders in building emotional resilience, ensuring decisions are made with clarity and logic. Moreover, joining supportive trading communities can offer solace during turbulent market times.

Final Thoughts

The realm of crypto trading is both vast and intricate. By equipping oneself with the right tools and knowledge, the tumultuous journey becomes clearer and more rewarding. As every seasoned trader will attest, continuous learning and adaptability are the keys to success in this ever-evolving landscape.