Credit reporting agencies are not infallible. One in five Americans has one or more mistakes on their official records. Repair providers remove them to boost the scores. This has far-reaching consequences.

Aside from borrowing, the total determines what apartments you may rent and what jobs you qualify for. It is checked by banks, insurers, recruiters, and landlords. But how exactly do professionals enhance it?

Table of Contents

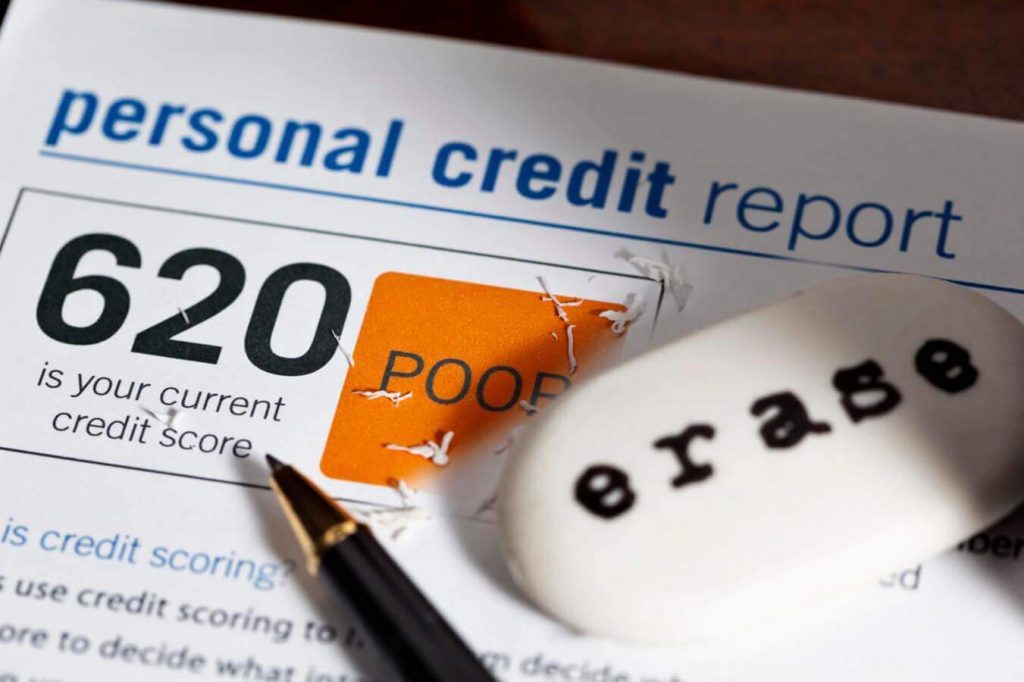

When Repair Works

img source: toptenreviews.com

These services are only useful when the score is unfairly low. This happens due to false derogatories reported to Equifax, Experian, and TransUnion. These agencies work independently and do not share information with one another. Therefore, any of the reports may be flawed, and they must be considered collectively. Credit repair reviews on https://creditfixed.com/ will help you choose a provider in your state.

There are many ways to view one’s own score. First, you may visit www.myfico.com. Secondly, there are mobile apps like Credit Sesame. It must be noted that lenders in the USA may also use VantageScore.

The differences, however, are minor, as a similar group of factors is assessed. The worst credit score in FICO is 300, while the best one is 850.

Every US citizen is entitled to a copy of their records once a year. It may be downloaded from www.annualcreditreport.com. Now, due to the pandemic, the frequency has been changed to weekly.

Downloading the files is the quickest way to access the information, but you may also call the company or send them a written request.

Description of the Process

img source: onsolidatedcredit.org

If the repair was easy, consumers would do it on their own. After all, nothing stops you from collecting evidence and opening disputes. However, there is a catch. Without expert knowledge, you will face many difficulties, and the process may get drawn out. Even with professional services, you should allow at least a couple of months, while the most complex cases take up to a year.

Preparation

img source: badcredit.org

It all starts with professional analysis. The experts will collect your records from all major bureaus: Equifax, Experian, and TransUnion. They will then scrutinize them going line by line. Professionals prioritize questionable derogatories based on their influence. For example, missed payments are extremely consequential for your result in FICO and VantageScore alike.

Communication with Lenders and Collectors

img source: bankrate.com

After the errors are identified, the team will gather information to prove them. First, it will consider your bank statements. Secondly, it may send formal letters to the banks requesting evidence (debt validation letters). The institutions must prove you owe the specified amount.

At the same time, the firm may send cease and desist letters to collection agencies if they are bothering you with calls. This method, however, requires caution. When the bank runs out of ways to reach you, it may resort to legal action. Credit repair specialists will determine whether these letters are appropriate.

Formal Disputes

img source: media.11alive.com

After the evidence is ready, the experts will proceed to draft and send customized dispute letters. These are addressed to credit bureaus. Every agency will have 30 days to respond, and you may need to contact two or three of them, depending on which reports are flawed.

A positive result means that the bureau accepts the changes and amends its records. Subsequently, you are sent a free copy of the report. Otherwise, the institution may ask for more information, or reject your claim. As you can see, it is crucial to collect sufficient evidence from the start, so there are no redisputes. Given the 30-day investigation period, they cause considerable delays.

Monitoring Tools and Support

img source: lynda.com

Throughout the process, you should have access to information on the company’s portal. Some firms have mobile apps, while others provide automatic alerts. The company must be reachable by phone every weekday, and big brands like Ovation Credit also work during shorter hours on Saturday.

Overview of Fees

img source: bankingdecision.com

Very few companies allow online enrollment. Usually, you need to call them or visit their offices. Upon sign up, you are charged a so-called first work fee or set up fee. This is an advanced payment that launches the analysis.

Afterward, you are charged at the end of each billing cycle that may vary between 30 and 45 days. The monthly fee may be equal to or different from the initial payment. For example, Sky Blue Credit Repair will charge you $79 six days after enrollment and $79 monthly. In comparison, Lexington Law charges between $89.85 and $129.95 monthly.

Additional Services

img source: enelgreenpower.com

Most providers divide their services between different levels — commonly, three. Customers may choose basic, intermediate, or aggressive repair. The most expensive bundles may include options like the official FICO tracker, identity theft protection, score analysis, TransUnion alerts, etc. There may also be a dedicated credit line, so you can rebuild the score along with repair.

Do not purchase the most expensive option unless you are sure the add-ons are necessary. Remember that repair lingers for months. The longer you use the services — the more you pay. Fortunately, these companies do not have fixed contracts. You may terminate your service at any moment and even get a refund if possible.

Money-Back Guarantee

img source: hostingadvice.com

No credit repair company will promise specific results. In this business, there are no guarantees, but you may get a refund. Every provider has its own policy with regards to cancellation.

Some firms do not provide compensation even if they are totally inefficient. Others pay your money back unless they remove a single derogatory within the first 60-90 days. Finally, Sky Blue Credit Repair has an exceptional policy. It is unconditional, so you may cancel at any time within the first 90 days and get a refund regardless of the reason.

The Bottom Line

The core repair services include the collection of information, analysis, preparation of evidence, and formal disputes. In addition, you may get extras like identity theft protection or TransUnion alerts. On average, fixing costs between $79 and $129.95 monthly. To find a reliable repair firm, consider ratings on BBB, customer feedback on sites like Consumer Affairs, and expert reviews.